Those nightmare moments!

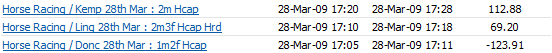

Every now and again you get these odd nightmare moments that you don't wish on anybody. Last weekend my main connection froze for a short period, but it wasn't a problem as I always have a back up running. On this occasion though , the lock up occured right at the point just before the off and I was caught cold. By the time I had turned to my back up connection , only seconds later, I'd dropped £120 or so.

These are often defining moments. No matter how much luck was against me and the potential loss I had, I just took the hit. One of the biggest mistakes I see people make at moments like this, is hoping the position comes back to a better resolution. When it doesn't, you will get hit hard. Trading is essentially a numbers gain, making fewer losses than profits, so failing to manage that will mean you are unlikely to make money longer term. If a trade turns to an outright gamble you will fail longer term, it's just inevitable. Not having defined entry and exit points and a positive expectancy for your trading will ruin you longer term, as will chasing losses. It's important to draw a firm line between the two.

Unfortunately there is nothing you can do about these things, they happen and should be part of your broader mix. Over time these 'exceptional' events tend to even out and that should give you comfort. But they only tend to even out over much longer periods. If you are reckless you may not get the chance to see the other side of the coin.

On this occasion the loss was pretty easy to overcome so it wasn't a major problem, but if I had let this one go, my big liability would have come in and I would be nursing a much bigger loss. As we move away from the jumps season, a clean exit become increasingly more important. Never lose focus on that.

<< Home